Aftermarket Parts Manufacturers: How to Win Pull-Through by Owning Technicians and Platforms

Aftermarket parts manufacturers don’t lose because their brands are unknown.

They lose because they fail to win the technician and the platform at the same time.

In today’s automotive aftermarket, demand is decided in a compressed moment. A technician looks at a screen inside a distributor portal, marketplace, or shop system. The platform controls what appears. The technician decides what feels safe enough to install.

If your brand does not win both, pull-through breaks. Margin erodes. Substitution rises. Private label gains ground.

This article explains why that happens and what aftermarket parts manufacturers must do to fix it.

The New Aftermarket Buying Reality

The traditional aftermarket buying journey no longer exists.

Manufacturers once influenced demand through awareness, relationships, and brand storytelling. Today, discovery happens inside platforms, and trust is validated by technicians under time pressure.

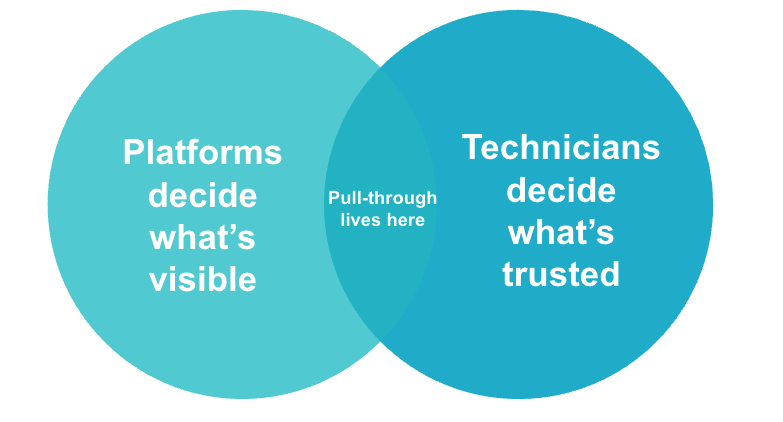

Two forces now control aftermarket demand:

- Platforms decide visibility

- Technicians decide trust

If a part does not surface clearly in the platform, it is not considered.

If it creates doubt for the technician, it is skipped.

This is not a branding issue. It is a system issue.

Why Awareness-Driven Marketing Fails Aftermarket Parts Manufacturers

Most aftermarket marketing is still built around awareness. That assumption is outdated.

Awareness exists outside the transaction. Platforms exist inside it.

A technician can recognize your brand and still choose another SKU because:

- it appeared first

- fitment was clearer

- EV or ADAS applicability felt safer

- documentation reduced install risk

That decision is not disloyalty. It is rational risk avoidance.

This is why manufacturers see a widening gap between marketing metrics and commercial outcomes. Marketing reports reach and impressions. Sales sees substitution, margin pressure, and growing private label share.

Awareness does not protect pull-through. Preference does. Preference is earned where decisions are made.

The Pull-Through Triangle for Aftermarket Parts Manufacturers

Sustainable pull-through requires alignment across three forces.

#1. Platform Visibility

Platforms reward brands that are easy to surface and easy to transact.

This includes:

-

- accurate and complete fitment data

- consistent naming and categorization

- clear EV and ADAS applicability

- reliable availability and pricing signals

When these fail, platforms deprioritize products mechanically. Not strategically. Visibility disappears quietly.

#2. Technician Confidence

Technicians choose parts that reduce uncertainty.

Confidence is built through:

-

- clarity at the SKU level

- install-relevant documentation

- clear risk boundaries

- visible support when issues arise

In Canada’s mixed vehicle parc, mistakes are costly. As complexity increases, technicians default to what feels safe.

Brands that create doubt are skipped. Brands that reduce risk are pulled through repeatedly.

#3. Commercial Alignment

Pull-through is not a campaign metric.

Manufacturers must align marketing, product, sales, and data teams around:

-

- repeat selection

- margin protection

- platform conversion

- long-term preference

When these functions operate separately, no one owns preference and pull-through decays.

The Cost of Losing the Technician

Technicians are now the most influential decision-makers in the aftermarket.

They are accountable for:

- comeback risk

- labour time

- shop reputation

- customer trust

As vehicles become more complex, technicians narrow their choice set. They rely on brands that remove friction and uncertainty.

When manufacturers fail to win technician trust:

- price becomes the main differentiator

- volume becomes promotion-driven

- private label becomes acceptable

- loyalty erodes quietly

In Canada, technician scarcity amplifies this effect. Brands that make the technician’s job easier win. Others become interchangeable.

The Hidden Cost of Losing the Platform

Platforms are not neutral distribution channels. They are decision engines.

Algorithms, filters, defaults, and merchandising logic shape what gets bought.

If your brand struggles with:

- inconsistent data

- unclear EV or ADAS applicability

- confusing product hierarchies

- weak documentation signals

the platform deprioritizes you automatically.

Once visibility declines, technician loyalty erodes over time. Technicians cannot choose what they cannot see. Behaviour rewires quietly.

Winning the technician without winning the platform is fragile.

Winning the platform without winning the technician is hollow.

Why EV and ADAS Make Pull-Through Non-Negotiable

EV and ADAS have raised the stakes.

Capability gaps are shrinking. Confidence gaps are widening.

Many aftermarket manufacturers can technically support modern vehicles. Few explain that capability in a way technicians trust at the point of decision.

Marketing often talks about innovation. Technicians want clarity:

- what vehicles does this fit

- under what conditions

- what risks exist

- what support is available if something goes wrong

Platforms surface specs. They do not surface reassurance.

Manufacturers that fail to translate capability into confidence lose EV and ADAS pull-through to dealers or entrenched brands, even when the product is viable.

A Practical Pull-Through Audit for Parts Manufacturers

Use this to assess where pull-through is breaking:

- Does your brand consistently appear across the key distributor portals technicians use?

- Is fitment data accurate, complete, and easy to scan?

- Is EV and ADAS applicability explicit at the SKU level?

- Can a technician understand install risk in under 30 seconds?

- Are marketing metrics tied to repeat selection and margin, not impressions?

If you cannot confidently answer yes to all of these, awareness investment is leaking demand.

What Aftermarket Parts Manufacturers Need to Fix First

This is not about doing more marketing. It is about doing different marketing.

#1. Audit platform visibility before increasing awareness spend

If your brand does not surface cleanly, nothing else matters.

#2. Treat product data as a growth lever

Fitment accuracy, naming clarity, and documentation quality directly affect conversion.

#3. Rebuild technician-facing content around risk reduction

Short, practical, install-relevant content wins.

#4. Align marketing metrics with commercial outcomes

Preference, repeat selection, and margin protection matter more than reach.

#5. Unify platform and technician strategy

They are no longer separate problems.

Pull-Through Is a System, Not a Campaign

Aftermarket parts manufacturers do not lose because they lack awareness.

They lose because they fail to win the technician and the platform together.

Platforms decide what is visible.

Technicians decide what is trusted.

Pull-through lives at the intersection.

Manufacturers that understand this protect brand equity, margin, and relevance.

Those that do not keep paying for awareness while demand flows elsewhere.

How Jan Kelley Helps Aftermarket Parts Manufacturers Win Pull-Through

Jan Kelley is a Canadian B2B automotive marketing agency focused on aftermarket parts manufacturers.

We help manufacturers:

- improve platform visibility

- earn technician trust at the point of install

- align marketing directly to pull-through and revenue

If you want to understand where your brand is losing preference inside platforms and what technicians see when they search, we can help.

Request a pull-through visibility audit and see how your brand performs where decisions are actually made.

Download our automotive aftermarket trends report here.

More Blog & Insights

" alt="" loading="lazy" role="presentation" />

" alt="" loading="lazy" role="presentation" />

Building Materials

5 Tactics to Better Understand Your Customers, Without the Guesswork

Many building materials brands will say they know their customers. And of course they do. They know their titles, roles and responsibilities. But knowing your customers isn’t enough to get selected. Understanding them is. Read more " alt="" loading="lazy" role="presentation" />

" alt="" loading="lazy" role="presentation" />

Automotive

Building a Data-Centric Marketing Organization is a Must

Successful modern marketing organizations have a data-centric culture. Read more " alt="" loading="lazy" role="presentation" />

" alt="" loading="lazy" role="presentation" />

Automotive

Reimagining The Rules of Imagination

AI is not a creative threat; it’s a creative catalyst. Read moreNever miss another blog post

Want to sign up for updates, announcements, offers and promotions from Jan Kelley? Simply fill in the form below and we’ll keep you up to date. You may later withdraw your consent at any time. Check out our Privacy Policy.